City Announces Sale Of Over 2,000 Lots Across South And West Sides

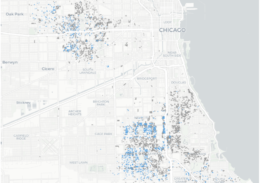

The City of Chicago has announced a new consolidated program to sell over 2,000 city-owned lots across various neighborhoods in the south and west sides. Focusing on neighborhoods like Englewood, West Englewood, New City, Garfield Park, North Lawndale, and Austin, the program aims at creating an equitable path for property ownership in areas that have long suffered from widespread disinvestment. Dubbed ChiBlockBuilder, it is being led by the Department of Planning and Development and city commissioner Maurice Cox with the blessing of Mayor Lori Lightfoot.