Updated details have been reviewed by the Committee on Design for the mixed-use development at 2033 N Kingsbury Avenue in Lincoln Park. Originally proposed late last year and revised earlier this summer, the new structure will replace a vacant lot adjacent to the future home of Lincoln Yards. Similar to the megadevelopment and another nearby proposal at 1840 N Marcey Street, Sterling Bay is behind this project which is being designed by local firm Pappageorge Haymes.

Site plan of 2033 N Kingsbury Avenue by Pappageorge Haymes

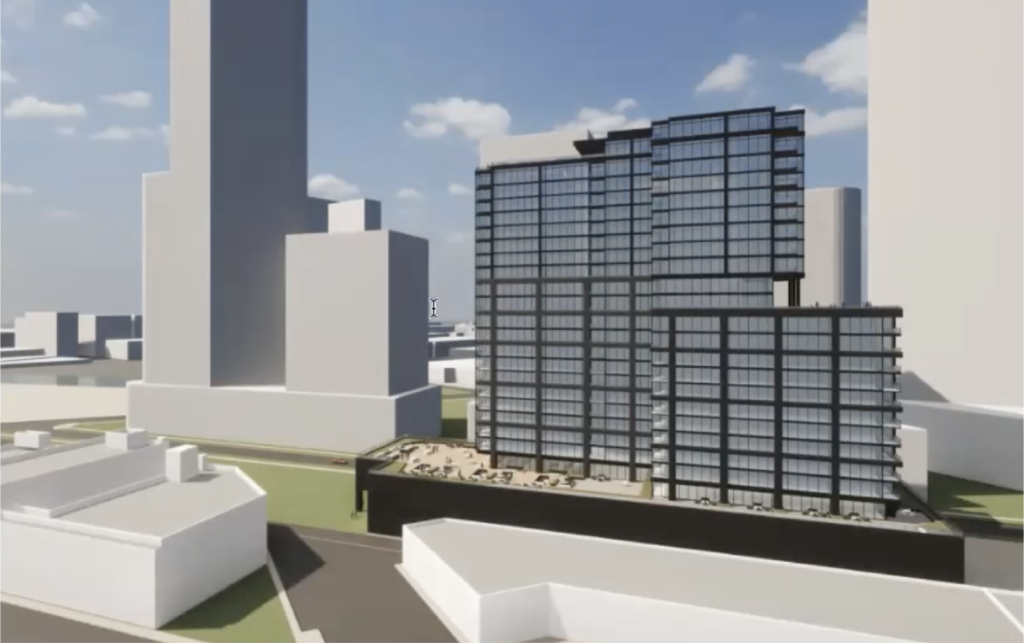

Iterations of 2033 N Kingsbury Avenue by Pappageorge Haymes

The relatively rectangular site has a unique wedged tip formed by a long-abandoned rail line, thus forcing the structure to rise on the northern end to avoid a complex form. However the proposal saw a major redesign this year which shed the original 15-story linear building for the current 25-story design which occupies a smaller footprint. The change allowed the team to provide nearly 70 percent more open space on the southern tip to become a public area.

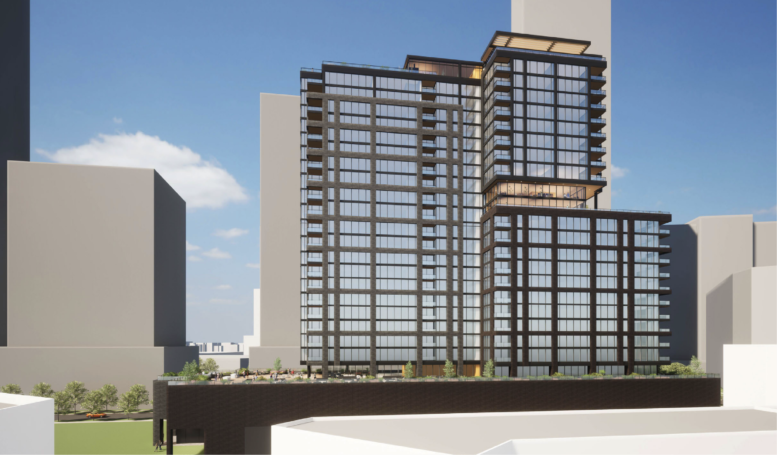

Rendering of 2033 N Kingsbury Avenue by Pappageorge Haymes

Now rising 275 feet in height, the tower will sit on a large three-story podium that still occupies a majority of the site and contains retail space along with 200 vehicle parking spaces. This element is what received the majority of the comments from the committee which touched upon the massive blank wall along the existing side alley, the need for the 200 spaces that are not required, and softening the overall design. The design team acknowledged these issues and will return to the drawing board to address them.

Ground (top) – low rise (middle) – high rise (bottom) floor plans of 2033 N Kingsbury Avenue by Pappageorge Haymes

Capping the podium will be an expansive amenity deck for the 359 residential units above, these will most likely be made up of studios, one-, and two-bedroom units of which 72 will need to be affordable. Setbacks on the 15th and 25th floors will provide additional amenity spaces and rooftop pool deck as well. The remaining comments focused on the overall design of the tower and its lack of differentiation from other similar developments.

Rendering of 2033 N Kingsbury Avenue by Pappageorge Haymes

Rendering of 2033 N Kingsbury Avenue by Pappageorge Haymes

Now having been reviewed by the Department of Planning and the Committee on Design, the proposal can proceed with its approval process though minor design changes are expected. It is unclear if this will delay its rezoning application and other approvals, it is also unknown if financing has been secured. However earlier this year Sterling Bay estimated a spring 2024 groundbreaking with a 2026 completion date.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

hopefully it gets approved, lincoln park is wayy too short

I’m really happy to see commentary here about the podium and the design review committee’s thoughts about it. Thank you, it’s a real issue that needs much more attention. We absolutely need to lessen the impact of cars on our city otherwise we’ll continue to destroy the environment, destroy the aesthetics of our city’s architecture (e.g. huge blank walls and dead spaces), and make it a deadly experience to walk/bike around. Fewer cars, this is the answer.

Very concerned about car traffic and parking with all the high rises in development. In addition to this one, there’s a high rise planned across from Jayson Home (~3 blocks away), 3 new mid-large apartment buildings almost completed by Whole Foods (another 3 blocks away), another planned for a block east of Whole Foods. The old Annexter building is also being converted to apartments/condos. Not to mention Lincoln Yards or the huge new properties at Halsted and Chicago ~ a mile away.

Why does it seem like they are moving forward with everything BUT Lincoln Yards.

I suppose the neighboring parcels getting developed will hopefully increase the likelihood of the main project being completed. But it seems odd to me

Because they don’t need to build the infrastructure for these surrounding properties unlike Lincoln Yards.

Lincoln Yards has been experiencing some difficulties securing funding now that interest rates are so high.

Maybe it’s easier to build these smaller developments, maybe more highrises in the area makes Lincoln Yards more attractive, or maybe they’re only doing this to demonstrate commitment to investors.