Potential financing has been revealed for the Lincoln Yards megadevelopment near Goose Island. The money would come from Florida-based Kayne Anderson Real Estate who is exploring becoming the primary financial backer for the project according to Crain’s. The 53-acre development has stalled as the lending market has changed since its original announcement in 2018.

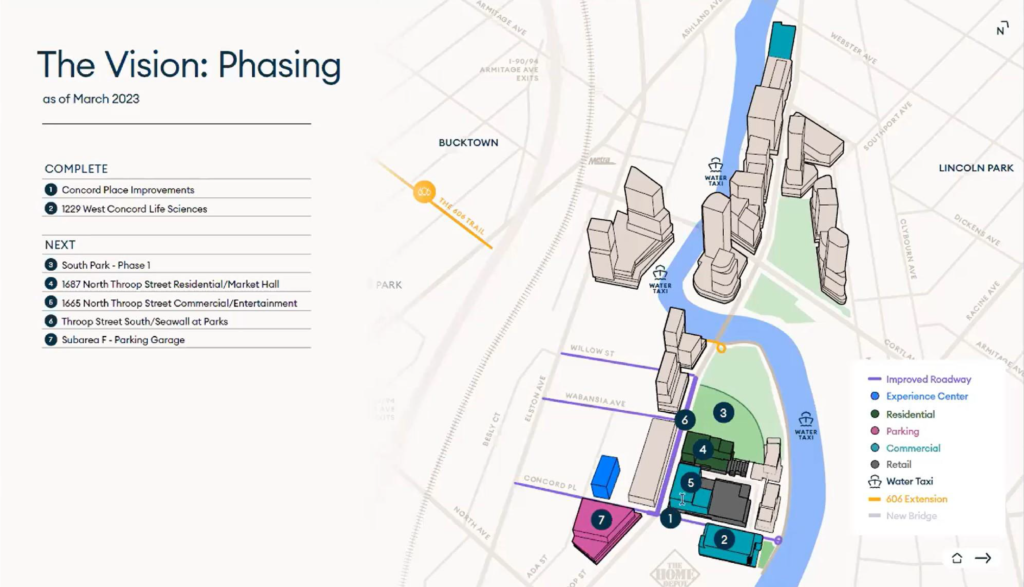

Phase plan of Lincoln Yards via Sterling Bay

With an estimated cost of $6 billion, developer Sterling Bay has completed a single building on the massive site’s south end. This being ALLY at 1229 W Concord Place designed by Gensler, aimed at life-sciences with 285,000 square-feet of space and rising 144-feet tall but has struggled to sign on tenants.

Rendering of the next phases of Lincoln Yards via Sterling Bay

In the last few years since Sterling Bay also announced the next phase of Lincoln Yards, the multi-building portion would include an office building, two-residential mixed-use buildings, a marketplace, entertainment center, and large central park just north of ALLY. This would be complemented by the next stretch of the 606 trail which the city announced almost a year ago, stretching under the highway and rail lines.

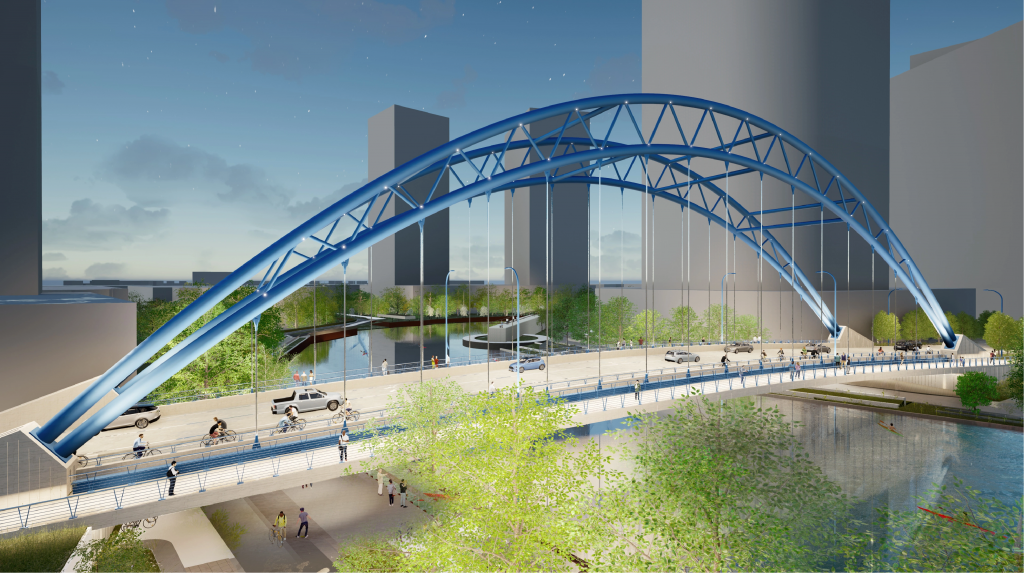

October 2020 rendering of Throop Street Bridge by Sterling Bay

After that, the developer announced multiple residential projects surrounding the megadevelopment in hopes to stimulate investments, these include 2033 N Kingsbury Avenue and 1840 N Marcey Street. But since then the developer lost its original financial backers of J.P. Morgan Asset Management and Lone Star Funds, before offering pitching the project to the Chicago Teachers’ Pension Fund for a $300 million investment.

Rendering of 1687 N Throop by HPA

Now it would appear both Kayne Anderson Real Estate and Darren Sloniger formerly of Marquette Companies are in talks to potentially be the main financial backers of the project, though the amount is unknown. According to The Real Deal the two were in town late February to meet with city officials over the current plans for the megadevelopment with no plans to amend the existing agreement.

Currently there is no confirmation on whether the two investors will move forward with the development.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

I really don’t understand why this has to be a mega development. Imagine if the city set the entire West Loop up to be developed by one single developer. It would never have happened and even if it finally did, it’d be a worse outcome.

Why not release/develop this land parcel-by-parcel (I understand it’s most likely too late to do anything differently on this)? Our tax money already has gone into reclamation of the polluted ground, why should a single private developer get all the benefit of the TIF money?

because one person owns all of the land

Brad, obviously you’re correct. But I agree with Jim and would pose the question to Sterling Bay. They made a ton of money in the West Loop due to the synergy of other developers bringing in projects at the same time. It created great energy. Imagine if they had platted the Finkl site out in city blocks/lots roughly the same size as in the West Loop. Then sold all but a few. They could have held on to dozens for themselves (imaging owning dozens of lots in the West Loop right now) and eclipsed their success in West Loop. I think they got a bit greedy and, ultimately, they’re going to have to cede some control anyway.

Exactly. It would be a win/win for everyone. Every time I look at these renderings, I think of Schaumburg or some office campus area in Texas. When you look at the West Loop/Fulton Market, it is very dense and becoming more dense with projects on each parcel. They could’ve sold off plots of land which could help ease the burden they face now. Instead we have this 10 year project, I’m sure now 20 years and it probably will look like a suburban campus in the end.

Exactly, very well expounded on. And it’s not too late. Why seek funding when they could do exactly what you said and have way better results. It’s almost like they don’t care about their business reputation.

The challenge with a transformative redevelopment is that it takes leadership to be able to implement all of the different components to make it work. This is one reason that single-family neighborhoods are so prevalent – they don’t require much thoughtful planning. In many cities, the City itself will work to develop and execute plans for major parcels that can be transformational. Chicago hasn’t shown the capacity to do this in recent years.

I should note, I’m not sure it’s really a good comparison with Fulton Market. Those are basically parcel-by-parcel redevelopments. This is planned to be a complete remaking of the local infrastructure, including a lot of new public amenities. To do that, the City, Park District, and numerous developers would need to work together. This is what the TIF plan should have done, but Chicago doesn’t really do planning anymore.

One way we could make this project better is embracing @StarLineChicago’s Build the Tunnel plan. This would electrify the UP-N and UP-NW, then connect it to the Metra Electric via a tunnel through River North and Lakeshore East. This would give Clybourn Station trains every 15 minutes (or better) to major job and entertainment centers all day.

This would also go a long way to addressing the issues with the Goose Island area developments that apparently everyone but the city can see coming.

Will, if this is a cheap stunt to get me to Google StarLineChicago…it worked. But what a disappointment. Train crawls?

Why are Trammel’s Fulton Labs filling up and 1229 Concord is yet to sign a tenant? Honest question.

Because it’s in the middle of a location worse than most of suburbia at the moment?

Yeah it’s not a desirable place to be. It’s really a “ if you build it, they will come.” thing but this is cart before the horse. Fulton has density, restaurants, things to do after work, public transit, and, critically, a lot of marketing and tech companies nearby that researchers can easily meet with to get product ideas and go-to-market plans. This area of LP is missing all that and more.

Fulton Labs is not quite filling up. It appears to have 1.5 floors currently occupied and roughly 2-3 currently being built out for the new tenant. The building was completed perhaps three year ago? There is a “life sciences” market, but generally it is synergistic with research hospitals, universities, etc. Look at Boston. Not much of that in Fulton Market or near Home Depot University.

With the collapse of the office market, they need to look at selling of the land to people who want to develop mansions with boat docks.