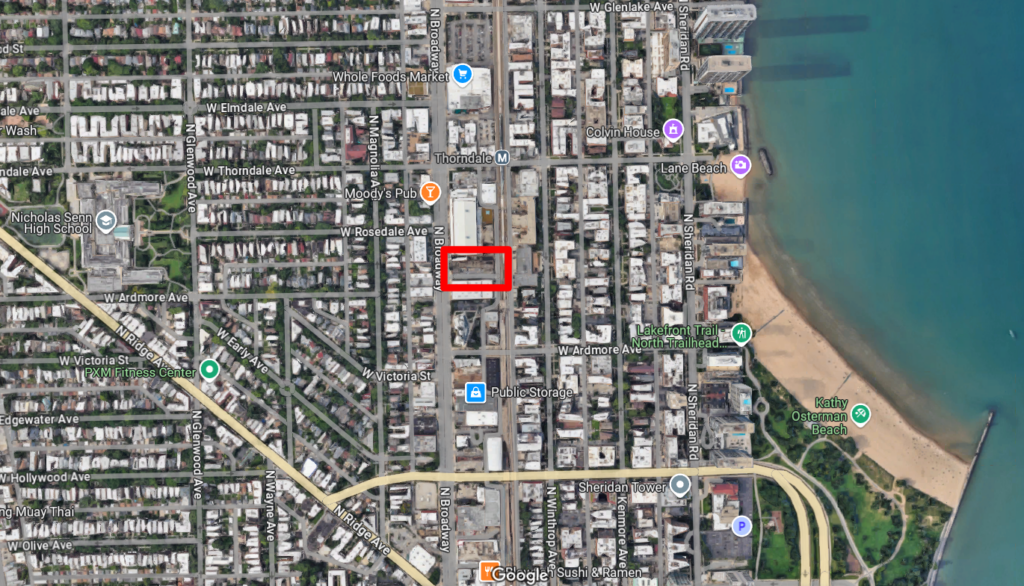

The Chicago City Council has approved an affordable housing development at 5853 N Broadway in Edgewater. Located near the intersection with W Thorndale Avenue, the project was first unveiled nearly three years ago and has undergone multiple rounds of community input. It received Plan Commission approval just a few weeks ago.

Site context of 5853 North Broadway via Google Maps

Rendering of 5853 North Broadway via LBBA

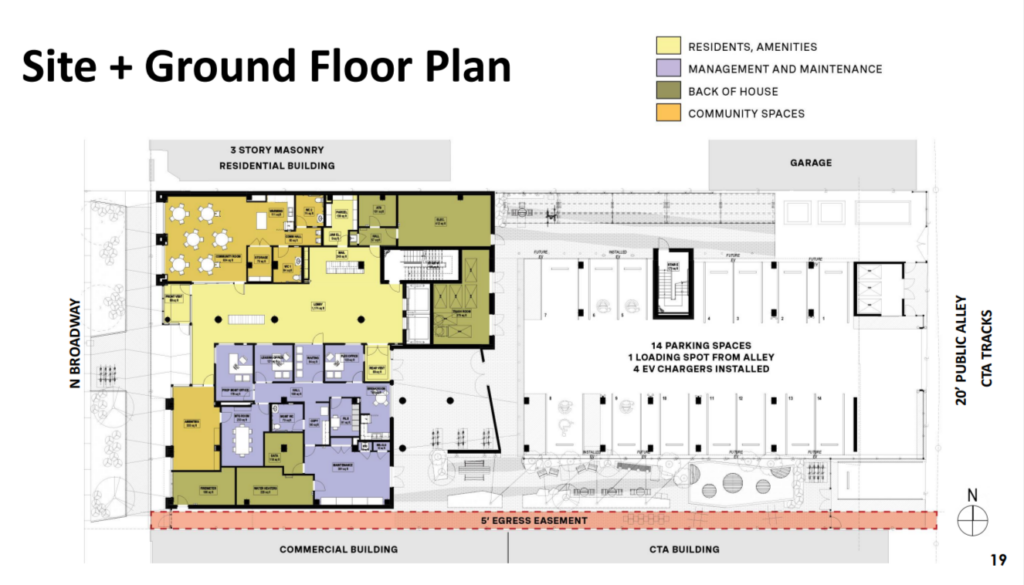

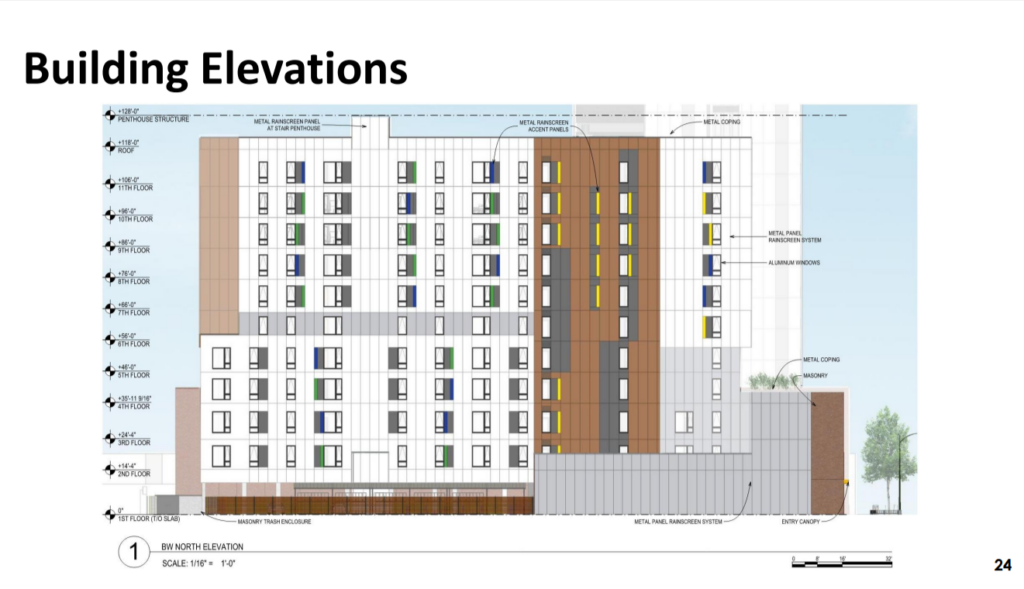

The development is being led by Bickerdike Redevelopment Corporation, with local architecture firm LBBA handling the design. To make room for the new building, an existing one-story commercial structure will be demolished. The new construction will maintain the existing streetwall with a three-story front section.

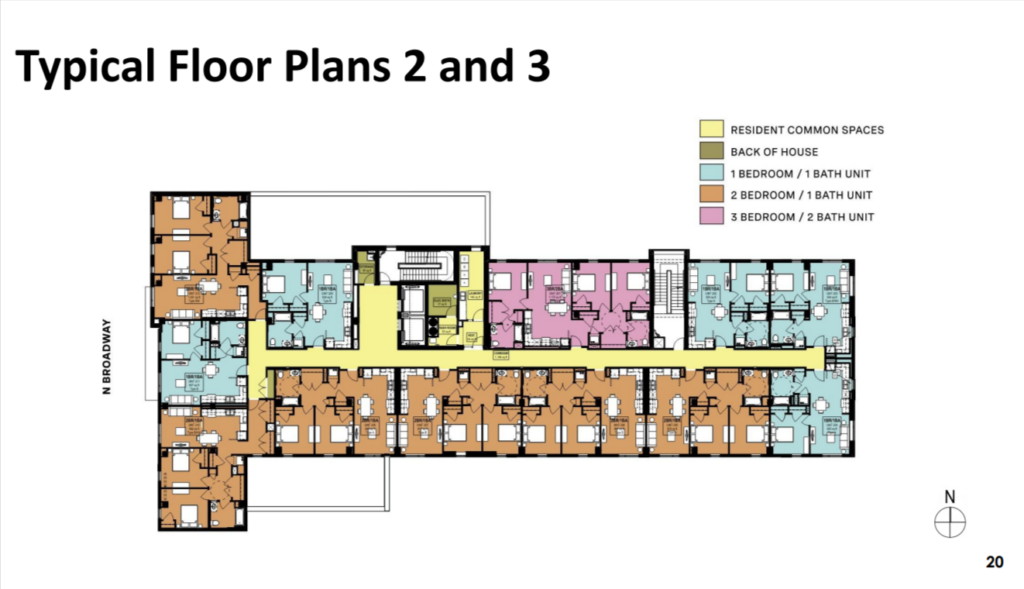

Behind this, the primary 11-story mid-rise will rise, containing the majority of the project’s 90 residential units. These will include 35 one-bedroom, 40 two-bedroom, and 15 three-bedroom apartments. All units will be affordable—85 designated for households earning up to 60 percent of the area median income (AMI), and the remaining five for those earning up to 30 percent of AMI.

Rendering of 5853 North Broadway by LBBA

Elevation of 5853 N Broadway via LBBA

Residents will have access to outdoor spaces, a community room, a bike parking area, and 14 ground-floor parking spaces. The building’s exterior will feature a mix of brick, white precast panels, and colorful accents.

With a total estimated cost of $71.1 million, the project secured Low-Income Housing Tax Credit (LIHTC) approval in 2024. The development team is now working to secure the remaining funding. Construction is expected to begin by the end of this year, with completion targeted for the second half of 2027.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

So happy to see this project hitting the road. It will be a great addition to the Edgewater neighborhood.

Community supports this development. An example of what can be done on deep lots on the east side of Broadway on surplus city land, with community input under existing zoning framework,to provide affordable housing.

This development is actually closer to the intersection of Ardmore and Broadway. This is a great location only three short blocks from Kathy Osterman Beach, steps from the CTA bus stop, and one Block from the CTA Thorndale Red Line station. Whole Foods is less than two blocks away, and the Jewel is four blocks away. Lots of restaurants, shops, pharmacies, live theatre, cleaners, shoe repair, bike shops all within a short walk.

$790,000 a unit. How can market price developers build regular condos and apartments for so much less than affordable housing developers. The graft and corruption is amazing. You could buy 90 condos in the loop to use as workforce housing at less cost.

Agreed-Affordable housing is code to developer for making a huge profit off the tax payers-nothing more.

Ah, look at the two commenters who have no clue about development or government lenders requiring reserves, operating costs, and more in that $790k per unit number.

Does anyone know any new information about 800 W. Lake in Fulton? Curious about that one.

That means that the average cost of a unit is $788,888 and most are studios and one bedrooms. Everyone should be against this massive waste of money. A developer who builds a condo unit for $788,000 would need to sell for over $800,000 and how many $800,000 studios and one bedrooms do you see selling in Edgewater? I’m for affordable housing but why are the taxpayers being ripped off to this degree?

The short answer is what Ezra Klein calls “everything bagel liberalism”, where every liberal project needs to accomplish so many liberal goals (union labor, workforce development, minority-owned contractors, etc.) that costs go way up and speed slows way down. Even if intentions are good, the inefficiency worsens the housing crisis.

Beautiful design, amazing about the construction cost. Not exactly sure how best to solve this unit cost issue. Hoping the New Residential Housing Corporation will help reduce with both construction cost and affordability matters. Appreciate that three bedrooms apartments are included in the floor plan.

Yes, please! Where do I add my name to waitlist for a 1 bedroom??

While opinions abound in this thread about why these units cost so much, it actually is a relevant question. I tried finding some constructive, fact-based explanations. If you type “why are affordable housing projects so expensive per unit?” in Google and see a link that says “The cost of affordable housing: Does it pencil out?” from The Urban Institute.

I cut and pasted some quotes below, but this site also has an interactive section where you can play the part of a developer to try to keep costs down.

I would be very interested to see what those of you expressing concern/outrage at the per-unit cost come up with using this simulation.

Some excerpts for your consideration:

“Development costs a lot of money. Developers rely on loans and other sources to fund construction before people move in and start paying rent. But developers can only get those loans and equity sources if the development will produce enough revenue to pay back the loans and pay returns to investors. The gap between the amount a building is expected to produce from rents and the amount developers will need to pay lenders and investors can stop affordable housing development before it even begins.”

and

“Can we close the gap…with bigger loans?

It’s fair to ask at this point: if there aren’t enough grants or tax credits out there, why don’t developers just take out bigger loans to get the building off the ground?

In short, the lenders won’t (and shouldn’t) let them. The size of the loan a bank will make depends on the project’s net operating income (NOI), or the amount of money it expects to bring in from rent after accounting for operating expenses.

Lenders use NOI to calculate how much debt a developer will reasonably be able to pay off, accounting for interest and recognizing the developer still needs to have some cash flow to cover unexpected expenses.”