Part two of this week’s announcement of the six finalists of the LaSalle Street Reimagined initiative in The Loop. In this article we will cover the final three bids vying for part of the city’s $196 million in funding for the program pulled from the LaSalle Central TIF District, part one covering the first three can be found here.

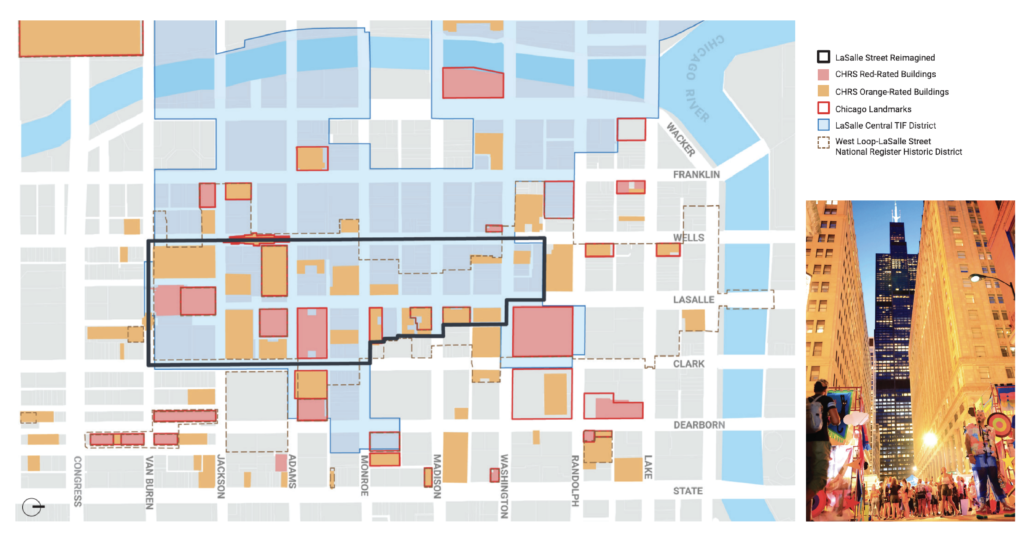

Map of LaSalle Street Reimagined which will be the same boundaries of retail program via City of Chicago

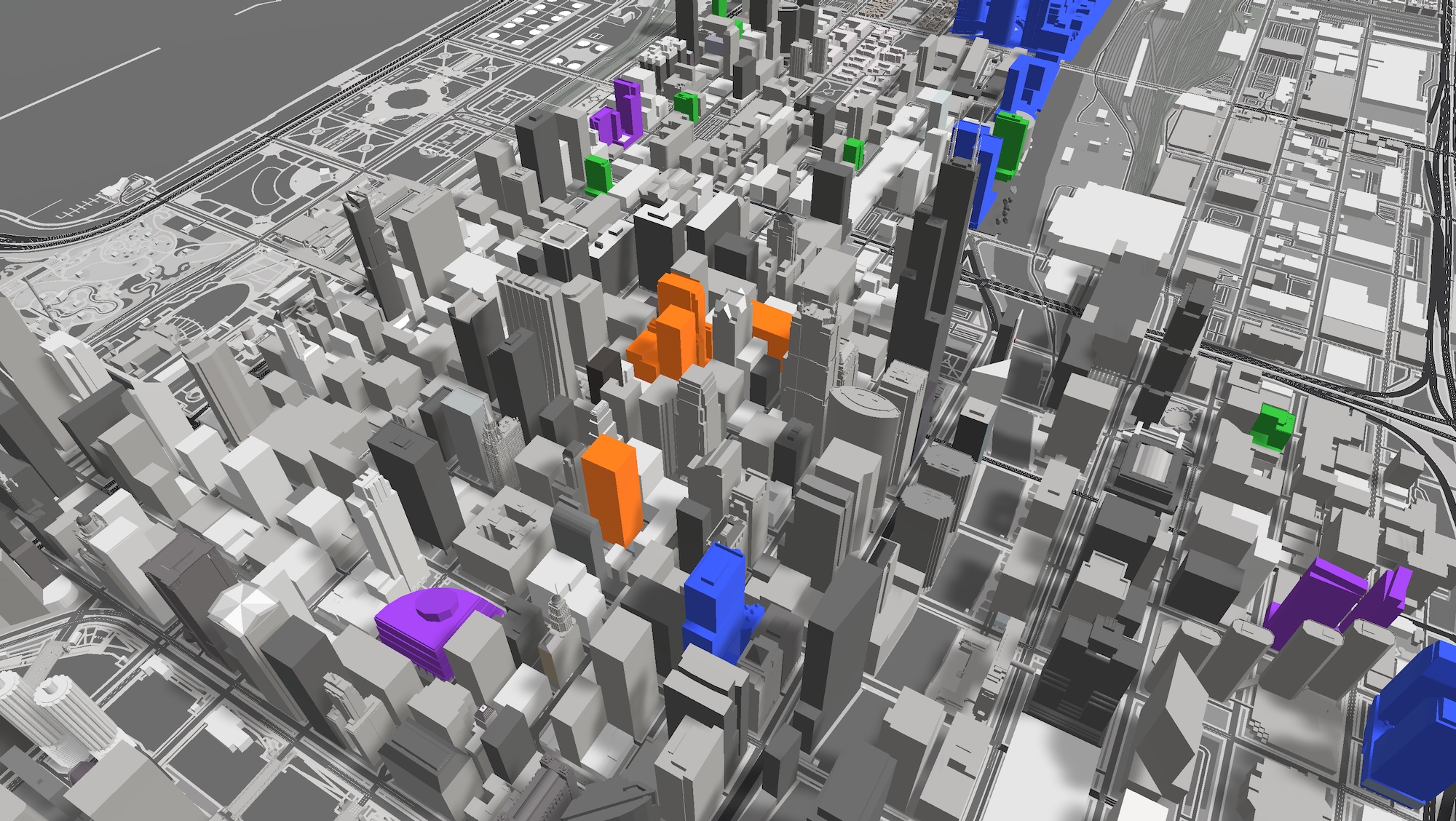

LaSalle Reimagined projects highlighted in orange. Model by Jack Crawford / Rebar Radar

LaSalle Reimagined projects highlighted in orange. Model by Jack Crawford / Rebar Radar

As a reminder, the program is being led by the Department of Planning and Development along with the Department of Housing with support from the city with the goal of developing partially vacant high-rises on the street. All bids had to include at least 30 percent affordable housing, mixed-use bases, and more.

Rendering of 30 N LaSalle Street by SCB

30 N LaSalle Street

Team: Golub, Corebridge, SCB, Confluence

Proposal Highlights: 432 residential units | 130 affordable units | $186 million – $431k Per Unit

The only bid proposing to redevelop a more modern building, the team is looking to turn half of the 1.1 million-square-foot, 44-story tower built in 1974 which recently went through a foreclosure. Starting at the base, the street front would receive a new plaza with updated landscaping and an added residential entrance complementing the existing retail. Floors 3 through 22 will become the 432 residential units made up of studios, one- and two-bedrooms ranging from 500 to 1,173 square feet in size.

Floor plans and renderings of 30 N LaSalle Street by SCB

One of the main features of the proposal is a new amenity level on the 11th floor with a large terrace projecting out towards the street level allowing for long vistas of the surrounding areas, with lounge, fitness, and party spaces behind new windows. It is worth noting the final 20 stories will remain as office space with their own separate entrance. The developers are asking for $75 million in TYF money as well as $44 million in loans to fund the endeavor, which they claim will be the quickest of all the bids with an early 2025 completion date.

–

Current view of 208 S LaSalle Street via The Prime Group

208 S LaSalle Street

Team: The Prime Group, Lamar Johnson Collaborative, Lucien LaGrange Studio, Cosentini Associates, W.E. O’Neil

Proposal Highlights: 280 residential units | 84 affordable units | $130 million – $464K Per Unit

Dubbed the LaSalle Residences, the project will redevelop part of the 1914 Daniel Burnham designed structure which currently houses the JW Marriott and The LaSalle Hotel. This leaves floors 13 to 17 vacant which would be converted into the 280 units made up of 111 studios, 120 one-bedrooms, and 49 two-bedroom layouts of which 30 percent will be affordable as they surround the structure’s central atrium.

Floor plan of 208 S LaSalle Street by Lamar Johnson Collaborative

A new residential lobby will be introduced along LaSalle as well as various new amenity spaces like a dog run and bike parking room, however the residents will have access to the existing hotel amenities as well. The project will be financed via $74 million in tax-exempt housing bonds, $33 million in TIFF and more with a similarly fast turnaround time, boasting a summer 2025 opening date.

–

Rendering of 135 S LaSalle Street by SCB

135 S LaSalle Street

Team: Riverside, Blue Star Properties, SCB, Vinci Hamp

Proposal Highlights: 430 residential units | 129 affordable units | $258 million – $600K Per Unit

Looking to redevelop the first Art Deco building in The Loop designed by Graham, Anderson and Probst in 1934, the development team will take on the 45-story, 1.2 million square feet structure mostly vacated by Bank of America in 2020. The proposal will begin by restoring the facade and focusing on the lower floors where 80,000 square feet of new retail space and lobbies will be built out around the existing historical arcade. Floors three and four will be retrofitted into a 180-vehicle parking garage with a new entrance from the existing alley.

Floor plan and program diagram of 135 S LaSalle Street by SCB

Floors five to 15 will hold the aforementioned residential units made up of 254 efficiencies, 116 one-bedrooms, and 60 two-bedroom layouts ranging from 585 to 1,147 square feet in size. Floors 16 to 42 will remain as office space with new rooftop terraces as the structure sets back as it rises, with new amenity levels throughout and a potential fresh market on the ground floor. The developers hope to finance the project via $115 million in TIF money, $34 million in tax credits and more, with an anticipated completion date in the first quarter of 2025.

–

Rendering of 135 S LaSalle Street by SCB

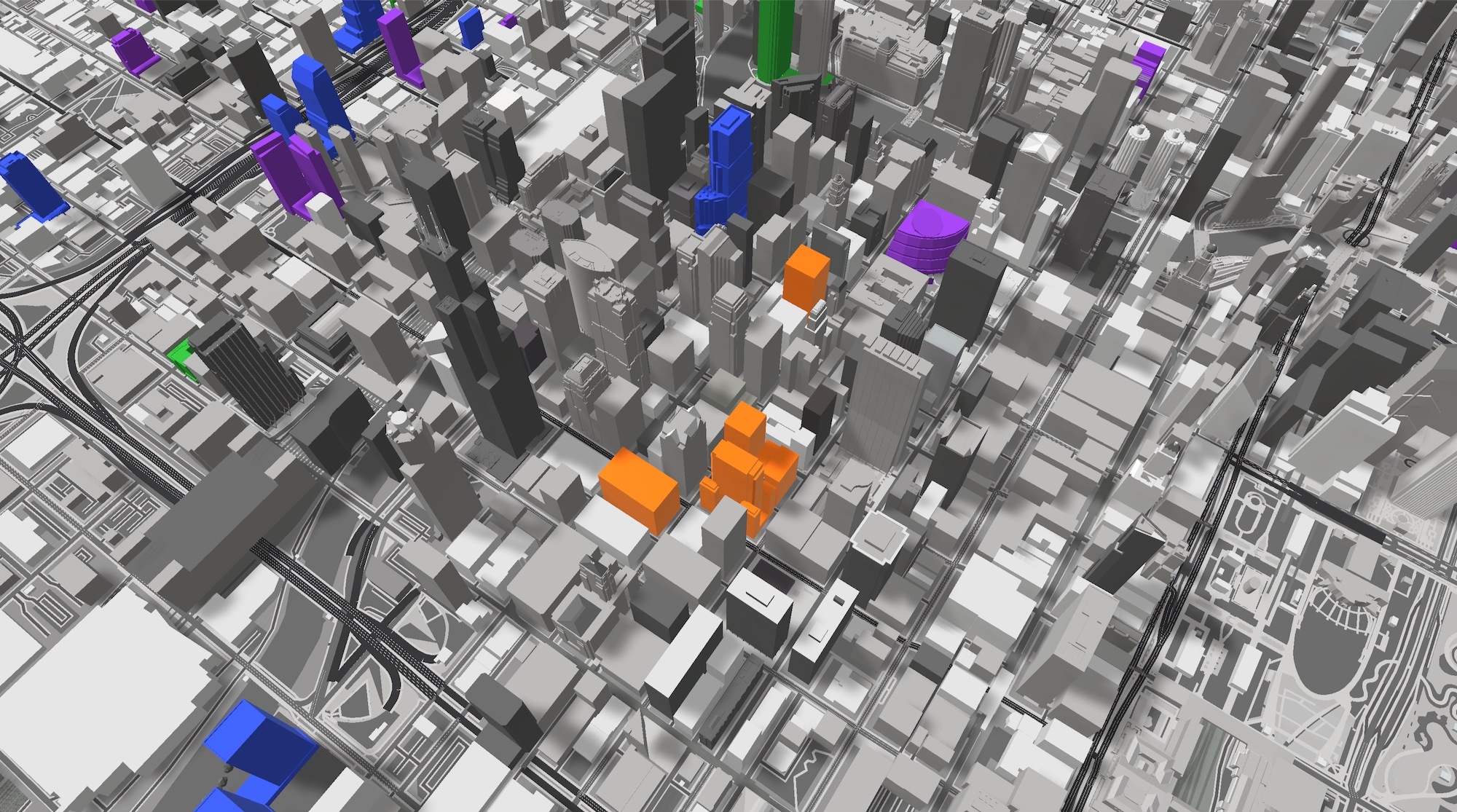

LaSalle Reimagined projects highlighted in orange. Model by Jack Crawford / Rebar Radar

At the moment the city is reviewing all of the proposals with a decision on the initial three to move forward expected later this month. Those moving forward will then have to clear the standard necessary city-approval for both the plans and funding prior to being able to move forward.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

For a street to be interesting, to attract pedestrians, it needs Retail Stores at street level. Chicago has never understand this. Who wants to be around buildings standing on pillars?

This is insanity. $196,000,000 of public money to build a tiny handful of “affordable” units in privately owned developments? If the city spent that money building units it owned, they’d get more low cost housing. Instead, they’re choosing to subsidize developments that will be privately owned.

$196,000,000. If that number doesn’t impress you, think of it this way: it’s $70 from every man, woman and child in Chicago going straight into the pockets of wealthy developers. This is insanity.

That’s a good way to illustrate it.

Isn’t it a TIF district not the tax levy supporting this? The citizens aren’t paying for this from my understanding.

TIF money is tax money that’s withheld from the taxpayers. The notion that citizens aren’t paying for this is something the politicians who want unaccountable play money have fostered.

Even if you convince. yourself it’s not taxpayers’ money, IT’S STILL A PUBLIC RESOURCE. It should still be invested in ways that generate the most public benefit.

Here, most – almost all – of the benefit goes to building owners. All the city gets is a handful of slightly rent subsidized apartments that are still owned by private parties. These schemes are a massive transfer of wealth to private landlords.

Wait so the money just is a tax free gift to the developers? Some rich dudes just get checks without having to develop architectural plans/designs, hire workers/contractors, procure materials, etc.? That does seem really unfair.

You should read up on TIF districts in Chicago. They are funds based on the increase in property tax revenues over time to be invested back in the community in which they are funded. They were originally supposed to be used in blighted areas where government assistance is needed to incent private investment, but now it seems that about half the city is covered in TIF districts. A lot of public infrastructure projects are funded partially by TIFs. Its ironic that the loop was completely undeserving of TIF funding in the past, but arguably is in need of support now that the bottom has fallen out of the loop commercial property market. Anyway, its not just check to rich dudes with no strings attached, but checks to fund specific projects. Whether these projects are worthy of those funds I’ll leave to another day.

TIF’s have just become play money for politicians. “Look at these lovely flower boxes, and rainbow pylons we paid for with TIF money! They didn’t cost the city a penny because they were paid for with magic TIF money! Re-elect me!”

The city needs the increased tax revenues – as we’re all aware, the city’s finances are precarious.

TIF projects have fairly stringent requirements. There are only certain “TIF eligible costs”. These projects are very expensive due to the adaptive reuse. It’s not as easy to convert an old office building to residential as it may seem. The goal of these projects is to not only provide affordable housing but also preserve these buildings and promote vibrancy in the heart of the City. Indeed, affordable housing is most needed in the most expensive parts of the City. I’m inclined to think it’s money well spent.